HISTORY

- CBIC launched, amended and streamlined a program to attract investments into India and to promote the Make in India movement.

- The Program was introduced in 2019 As MOOWR(Manufacture and Other Operations in Warehouse).

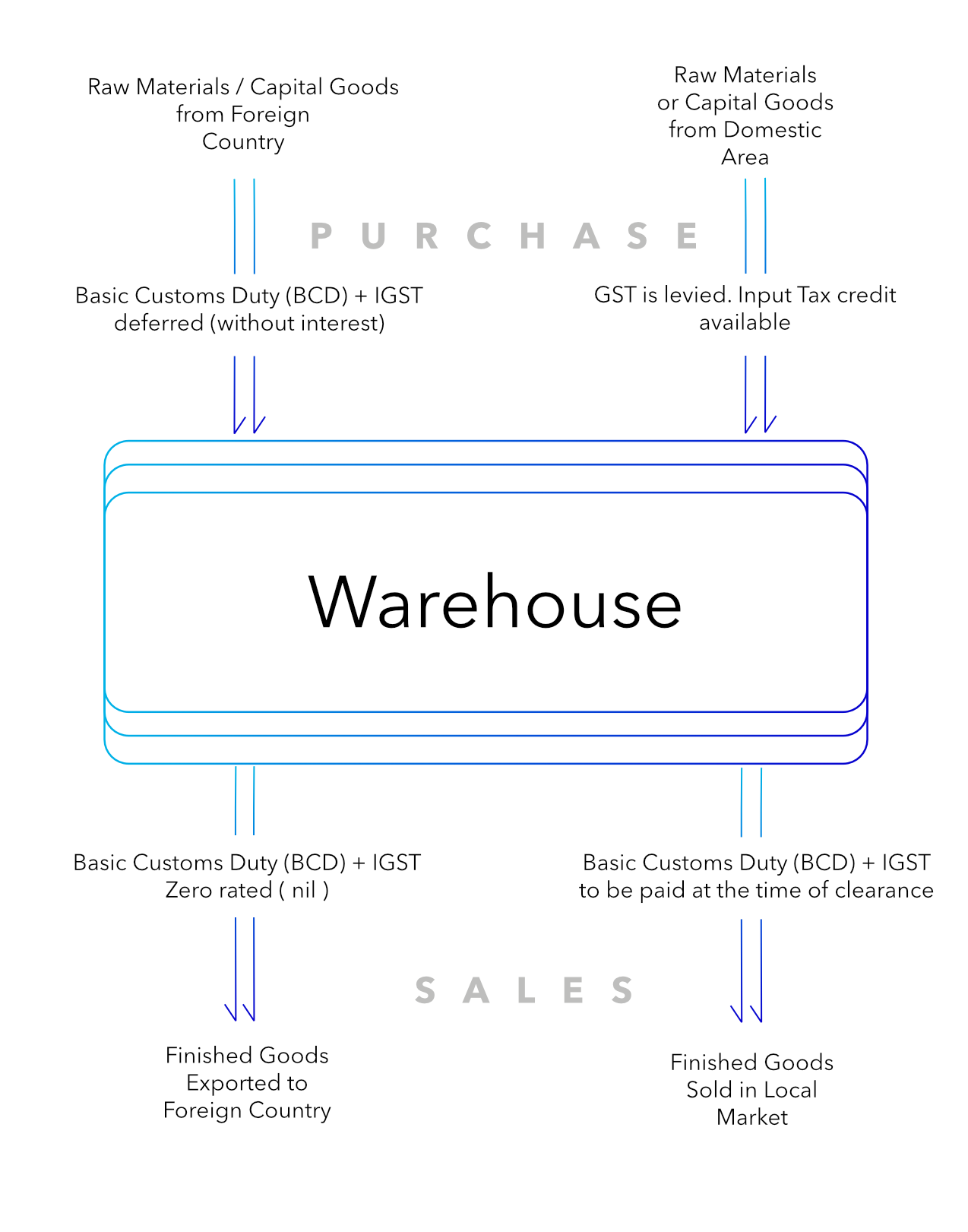

- The Program enables handling (conduct) of manufacture and other operations in a customs bonded warehouse.

- This Program allows manufacturing and other operations in a bonded manufacturing facility to promote India as the manufacturing hub globally and the commitment towards ease of doing business.

- The most promising feature of this scheme is that unlike various existing schemes, the MOOWR scheme is delinked to the quantum / obligation of exports and the benefit is also extended to the importers who import the goods for domestic clearance / selling